Church leaders, MPs and charity bosses have welcomed the announcement of a raft of measures to clamp down on payday lenders. Andy Walker reports.

OF the 500 or so people to have visited the Citizen’s Advice Bureau office in Darlington since April, half of them had payday loan repayments hanging over their heads.

The charity says these alarming figures represent a huge rise on the previous year – a trend which has been repeated in other parts of the region and around the country.

Among the restrictions outlined by City watchdog the Financial Conduct Authority (FCA) are plans to limit the number of attempts lenders can make to claw back money from struggling borrowers’ bank accounts.

Under the proposed new rules, due to take effect next year, lenders will have to place risk warnings on their promotions and advertising. The watchdog will have the power to ban adverts it considers misleading. Payday loans are used by an estimated two million cash-strapped Brits each year, with demand in the North-East among the highest in the country.

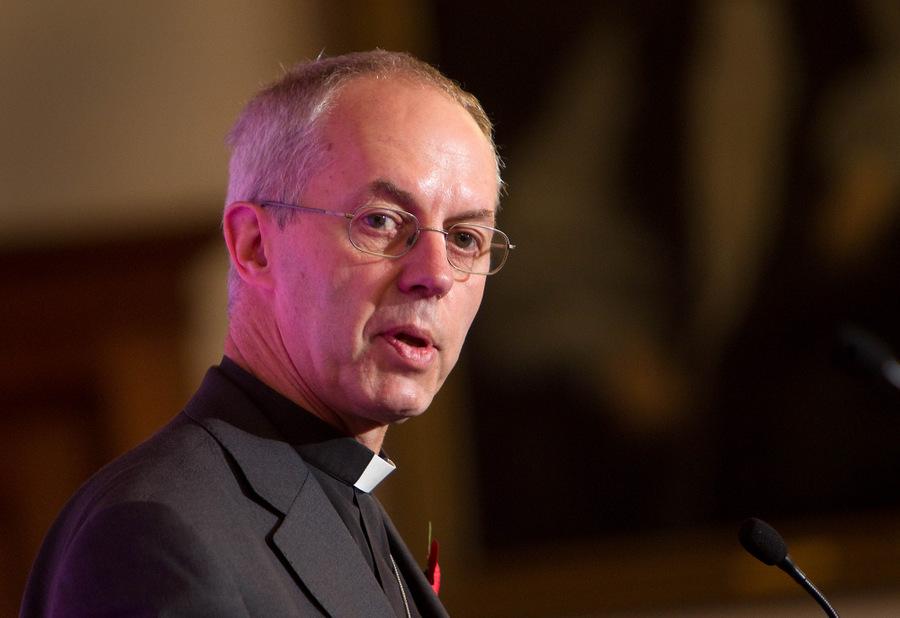

Archbishop of Canterbury Justin Welby, the former Bishop of Durham, was among the first to welcome the proposals. He sparked controversy recently after telling Wonga, one of Britains best-known payday lenders, that the Church of England aimed to ‘compete it out of existence’ as part of plans to expand credit unions. Wonga racked up profits worth tens of millions of pounds in the last financial year, while charging annual interest rates of more than 5,000 per cent.

Last month, Darlington Borough Council banned access to payday loan sites from its computers in an effort to discourage high-interest borrowing. This newspaper has backed a campaign calling on the public to reject payday lenders, offering free advertising for accredited credit unions, which are seen as an alternative to payday lenders. Savings accounts, free financial advice and affordable loans are among the services available from credit unions.

Darlington MP Jenny Chapman has repeatedly raised the issue of payday lenders, campaigning for an end to what she calls ‘legal loan sharks’. Mrs Chapman visited the town’s CAB office, in Horsemarket, on Thursday (October 3), where the charity’s debt team told her the rise in those seeking advice and help was of great concern. She said the proposed measures do not go far enough and called for a cap on the total cost of credit.

“I welcome the focus of the FCA on legal loan sharks and their research into capping,” she says, adding: “The lack of real action on the actual cost of credit itself will be a blow for the many residents caught in a spiral of debt due to payday lending. These measures will go some way towards limiting some of the damage being done, but frankly they won’t prevent them like capping would.

“I hear all the time about the misery these loans cause, and the reality is that it’s the cost of credit itself which causes problems. The Darlington CAB team works incredibly hard to support people caught up in this, and I would like to place on record my thanks to them.”

Mrs Chapman also voiced her support added she was fully supportive of the Darlington Credit Union, which like countless others offers a lifetime for families on the breadline.

Neeraj Sharma, who runs the Darlington CAB office, called the plans ‘long overdue’. Nationally, the charity says there has been a ten-fold increase in payday loans over the past four years.

“We've long been calling for tough action to tackle payday lenders after the appalling behaviour of some has driven people deep into debt and caused unnecessary hardship,” says national chief executive Gillian Guy. “The new rules from the FCA are essential to stem the tide of predatory payday lenders and protect consumers from unacceptable behaviour from the credit industry. All too often, people are given loans without proper checks or assessments as to whether they’ll be able to afford to repay.

“Some people are left without money to get to work or put food on the table as lenders take payment after payment out of people’s bank accounts without any warning.”

The plans will put a stop to some consumers being able to get approval for a loan inside ten minutes, said FCA chief executive Martin Wheatley. Pledging to make the process lengthier, he said the fact funds are so readily available points to a lack of affordability checking on the part of the lender.

Consumers will be pointed in the direction of the Government-backed Money Advice Service for help. Warnings will be similar to those used by mortgage lenders, which remind borrowers that they may lose their home if they fall behind with payments.

The FCA, which has powers to impose unlimited fines and compel businesses to give people their money back, takes over control of overseeing the consumer credit market, including payday lenders, from the Office of Fair Trading, on April 1 next year.

The £2bn industry is undergoing an investigation by the Competition Commission, which is due to produce a full report towards the end of next year.

The Consumer Finance Association, a trade body which represents short-term lenders, described the FCA announcement as ‘an opportunity to set a bar over which irresponsible lenders will struggle to jump’.

Under the proposed rules, adverts by payday loan companies will carry the following financial health risk warning: “Think! Is this loan right for you? Over two million short-term loans were not paid off on time in 2011/12. This can lead to serious money problems.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here