WEALTHY bank customers had their accounts emptied of tens of thousands of pounds after gang members pretended to be them.

Crooks got access to the diaries at branches of Lloyds, hijacked planned meetings with staff and posed as the real clients and a relative.

They asked for their accounts to be joined after coming up with elaborate stories – then quickly either spent the money on designer watches and clothes or moved it to their own accounts.

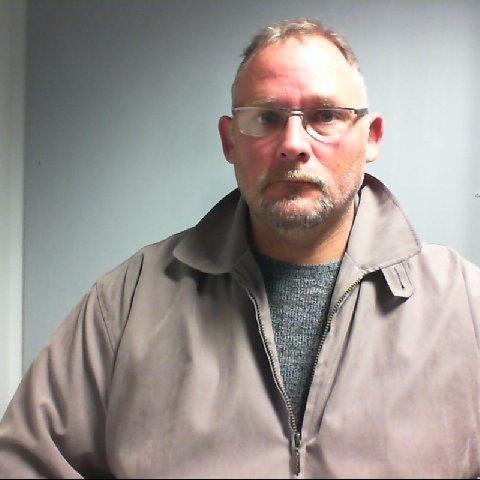

Details of the scam came to light when North Yorkshire man Jamie McKee was arrested along with former military police officer Shaun Orton and his one-time colleague Matthew Bookbinder.

Prosecutor Paul Newcombe told Teesside Crown Court that one "high-roller" lost £66,900 and another had a total of £84,630 "drained" from his account.

Orton visited a jewellers in Sheffield and bought a £17,000 Rolex, and tried to get a £25,000 watch in Nottingham, but his card was declined.

In just 12 hours, £50,000 was transferred into other accounts, and Orton paid a final £1,500 into his partner's bank – said to have been his "pay" for his part in the crime.

The man he visited the branch in Sleaford, Lincolnshire, with in August 2016 has never been traced, and neither have others who were said to be higher up the chain than this trio.

KcKee and Bookbinder visited a branch in Rotherham, South Yorkshire, the following month and carried out an almost identical swindle.

Bookbinder, 45, posed as the legitimate customer, while McKee, 24, said he was marrying into the family and wanted to join accounts to help fund a honeymoon.

Even though Bookbinder dropped his real bank card on the floor during the meeting, he was able to "hoodwink" the suspicious member of staff with a false story, Mr Newcombe told the court.

The prosecutor said Orton, 40, recruited Bookbinder and there were emails which showed him giving instructions on what to do and how.

"In the same way, the funds were dispersed quickly," Mr Newcombe told Judge Simon Hickey. "By half past midday the same day, McKee and another had bought a Rolex for £32,200 at the Meadow Hall shopping centre near Sheffield.

"At a jewellers in the city centre, a £26,350 Rolex was bought, and McKee also bought clothes worth just under £600. A further £25,000 was transferred from the account during the course of the day.

"The final insult was McKee went to various cashpoint machines and took out what was left."

His barrister, Amrit Jandoo, told the court: "There are clearly others involved higher up the chain able to extract the money directly.

"Mr McKee was not aware of the amounts that were going to be taken, and was not aware where the money was coming from."

Mr Jandoo said father-of-one McKee was picked up by a BMW driver and taken to the shopping centre, told what to buy and received £200 for the part he played.

Abi Whelan, for Orton, said he made contact with somebody who was advertising on Facebook with a promise of making extra money.

Miss Whelan said after his initial visit to the bank, he was contacted again by the threatening gang "on a fairly relentless basis" and recruited former colleague McKee "to take some of the pressure off him".

Orton has recently been diagnosed with post-traumatic stress disorder as a result of seeing a tragedy while working on an RAF base, and his relationship has crumbled, the lawyer said.

Holly Betke, for Bookbinder, said he was in debt, had bailiffs knocking at his door and was desperate for money when he was recruited by Orton.

"He had not realised the scale of this operation, and he certainly isn't an orchestrator of it," Miss Betke said. "He absolutely made the wrong decision to get involved."

McKee, of First Avenue, Colburn, admitted conspiracy to steal and was jailed for 18 months.

Orton, of Oakhill Road, Doncaster, South Yorkshire, pleaded guilty to conspiracy to steal and fraud, and received a prison sentence of three years and nine months.

Bookbinder, of Andersons Road, Southampton, was given 16 months after he admitted theft.

Judge Hickey told the men they had been part of "an audacious, planned and sophisticated" crime, and had to be locked up.

A Lloyds Bank spokesperson said: “Where illegal activity is identified we will support the police with their investigations . Where there is evidence of criminal behaviour to the detriment of our customers, we work quickly to ensure that our customers are appropriately supported and are not left out of pocket.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel