TENS of thousands of children across the region are at risk of mental illness due to their families being trapped in debt, according to research.

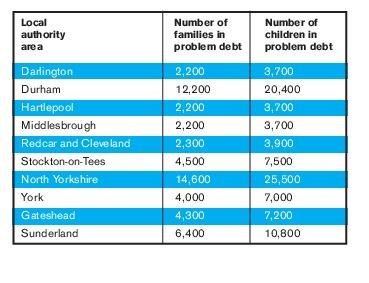

The study, commissioned by The Children’s Society, shows that more than 90,000 children in the North-East are living in 55,000 families trapped in problem debt.

In North Yorkshire, there are 25,500 children living in 14,600 families struggling with debt problems.

The Children’s Society says that youngsters in low-income families with multiple debts are at far higher risk of experiencing mental health problems than those in families who owe money to a single type of creditor.

In some cases children are going without basics such as food, clothing or heating, as well as suffering worry, anxiety and bullying.

In Darlington alone there are 2,200 families trapped in problem debt, while in the wider County Durham area the figure is 12,200.

This equates to an estimated 24,100 children in the region affected by their parents’ debt.

The Children’s Society is now urging the Government to introduce a 12-month ‘breathing space’ scheme to give struggling families a period of protection from additional charges and enforcement action while they put their finances in order.

Today the charity is publishing a draft of a parliamentary Bill to make this ‘breathing space’ a reality for hundreds of thousands of families.

Rob Jackson, North-East area director at The Children’s Society, said: “Again and again we have raised the urgent problem of families who are trapped by debt, and whose children often pay the price with their mental and physical health.

“With unfair and unsustainable repayment plans, hidden charges, soaring interest, visits from intimidating bailiffs and the fear of eviction, the odds are stacked against parents who are desperate to find a way out of their debt.

“Meanwhile mums and dads are being forced to make impossible decisions between feeding and clothing their children, and paying the bills.”

The four most common debt problems revealed by the survey are arrears on energy bills, followed by loans from friends and family, bank loans, and council tax.

The evidence, based on a survey carried out by Opinium, also shows that families with children are more than twice as likely to have been trapped in problem debt as childless households.

The survey found that, across England and Wales, 20 per cent of families with children have struggled with problem debt in the last year. By comparison, the proportion of households without children who have fallen into arrears with one or more creditors is just under eight per cent.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here