FROM thwarting terrorists to aiding the early detection of cancer cells County Durham technology firm Kromek has lifesaving markets worth billions within its grasp. Andy Richardson visits an 11-year-old company that is finally coming of age.

HIS New Year celebrations were given an extra sparkle when Arnab Basu was named in the Queen’s list of MBE recipients.

By Easter, the Kromek chief executive had been forced to issue a profits warning when it became apparent that the Sedgefield-based imaging firm was going to fall short of predictions for a stellar 2014.

Cynics had a field day, accusing Kromek – long hailed as a rising star of the homegrown tech industry – of being ill prepared for the rough and tumble of life on the stock market. But a week after Dr Basu had what he admits was his toughest day as Kromek boss, he was announcing a deal worth up to £95m.

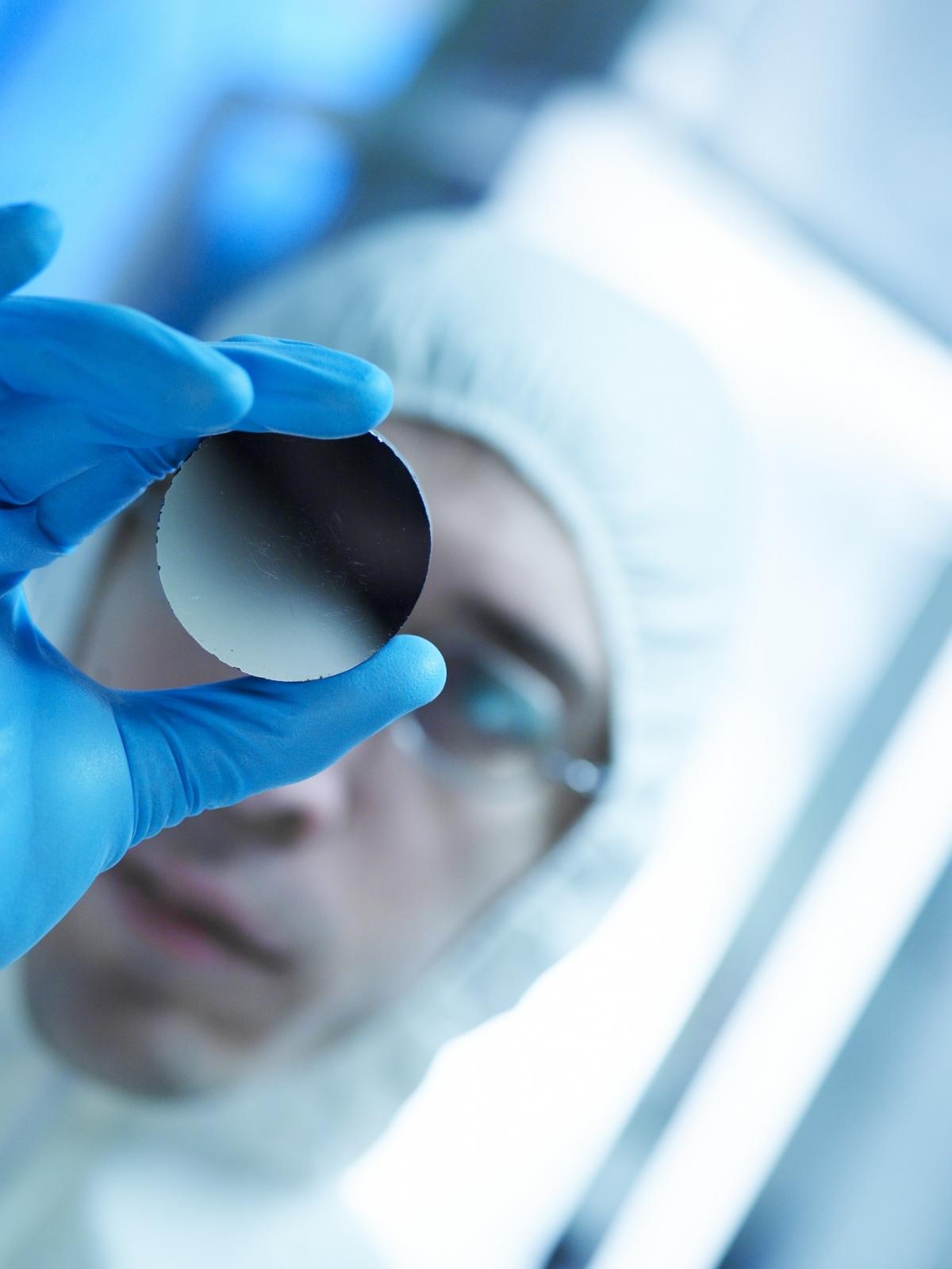

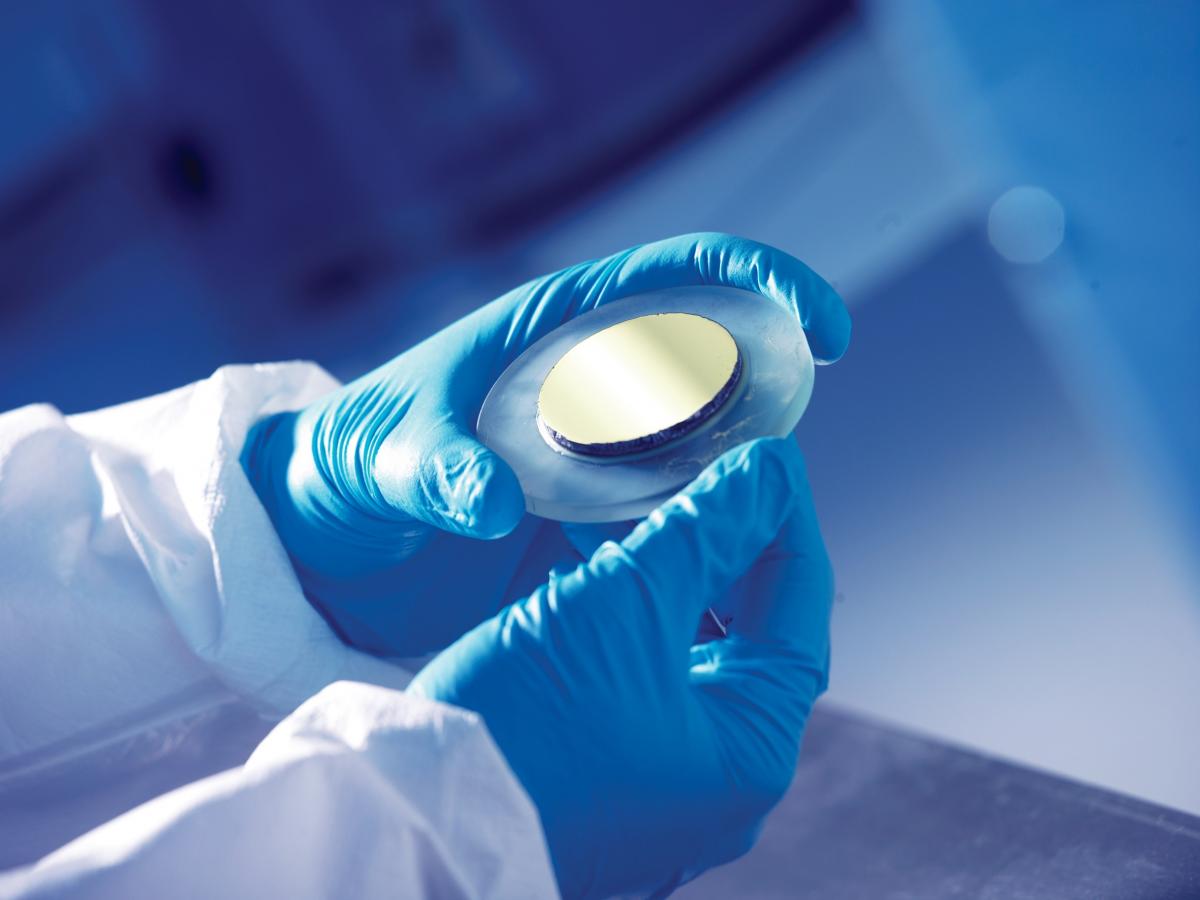

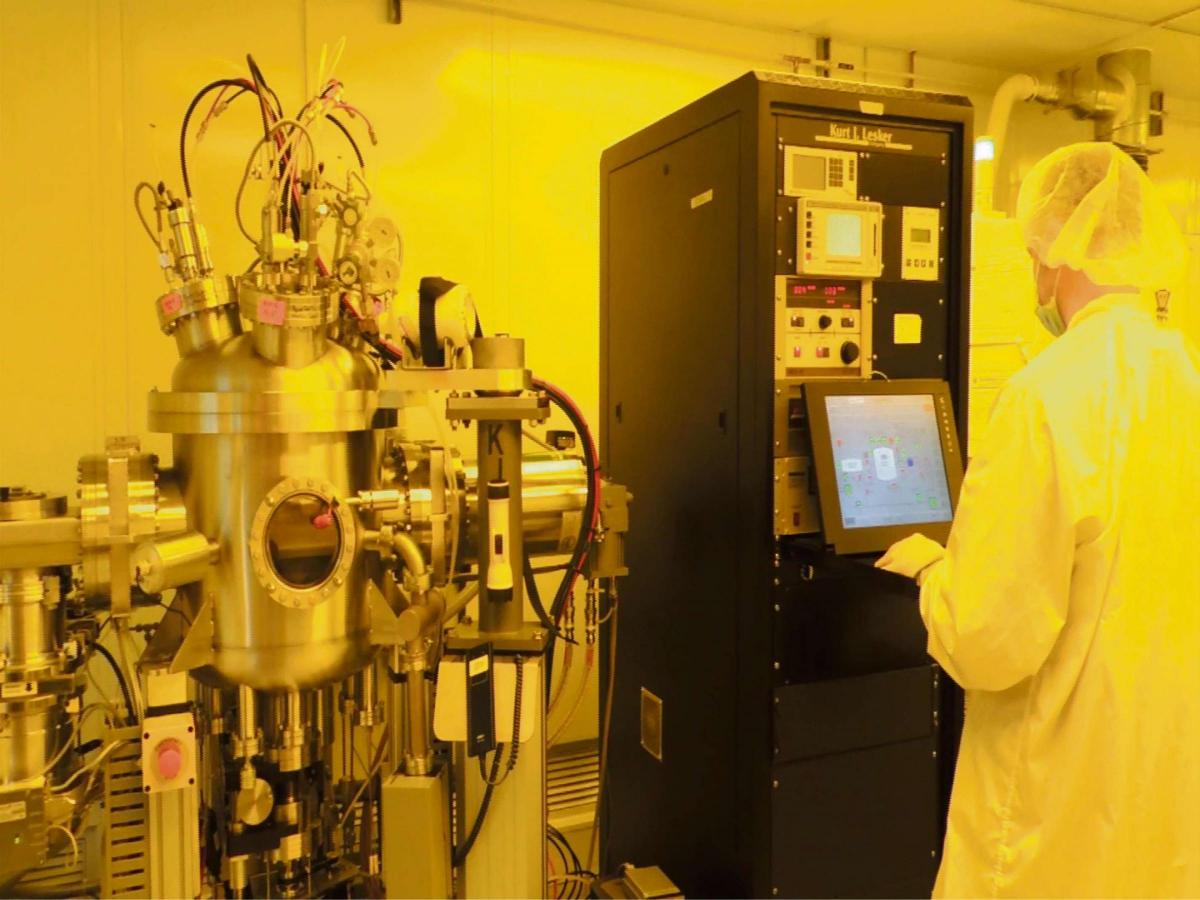

This month (JUNE), as part of a £1.5m investment the firm will begin installing 24 new furnaces which make the cadmium zinc telluride (CZT) crystals, which are the cornerstone of everything Kromek does.

A recruitment drive has been launched for new sales team, and more multi-million pound deals are in the pipeline.

Perhaps 2014 will turn out to be a great year after all.

Kromek, formerly known as Durham Scientific Crystals, started as a two-man spin-out from Durham University’s physics department in 2003. It will employ about 125 people by the end of this year, half in County Durham and the rest in offices in America and Germany.

The myriad applications for CZT means the firm is able to target three distinct markets – medical and nuclear imaging, as well as airport security. Dr Basu admits that at some point in the not too distant future it could split into three separate entities.

For the time being, the firm’s strategy is to be the dominant player in its field, with new sales staff being brought in to lead the three-pronged drive.

“Whether we are talking about the nuclear, airport security or medial sectors this business is about making our lives safer,” says the Calcutta-born entrepreneur, who rejected the chance to work in China and London to build an empire from County Durham.

“If I look at the medical imaging sector that we address it is worth $10bn, security is $41.5bn and the nuclear market for us is huge. There are opportunities everywhere we look.”

The challenge for Kromek is to find the right customers. Delays to orders made by UK and US governments were among the reasons why the firm warned on its profits, but investors are taking a long-term view, and the firm’s growth potential remains unbowed.

Kromek is best known for pioneering an airport scanner that can identify liquids in bottles, including explosives, alcohol and narcotics, without opening them, in less than 20 seconds.

There is demand for airport x-ray machines to become increasingly sensitive and sophisticated. Since 9/11 passengers have become accustomed to restrictions on liquid being carried into the passenger cabin, but as these rules are gradually relaxed, Kromek’s high sensitive detector will open up significant opportunities.

Dr Basu continues: “If you look at the rate of growth of cancer in China there is a need to bring down the cost of prevention and identify the disease earlier, so it can be treated more effectively.

“Diagnostic imaging is a key thing in the healthcare system. If you catch something earlier you reduce the cost of treatment. Mayo clinic in America did a mammography where the normal system showed no cancer, but the CZT system showed cancer. The users know how effective CZT based systems are.

“The security business relies on a state of fear. Gone are the days where we could focus efforts on huge, dumb, static security systems at airports and ports where bad guys could be caught. Sadly, the bad guys are getting very smart so the security industry, government agencies and regulators have to keep up with the changing nature of the threats.

Last year, the firm extended its presence in the US following the purchase of Pennsylvania-based Endicott Interconnect Detection and Imaging Systems (EIDIS).

“They were the pioneers in this field and monopolised the market,” Dr Basu explains. “As new players like us came up they lost that grip. Their ownership model proved very clunky. So we were able to buy them out last year. It now gives us a dominant position globally in our field with about 65 per cent of the CZT market.

“We have the ability to grow much faster than any of our competitors and will end up with the lion’s share of this market.”

Three years ago, Kromek bought US firm Nova which boosted its manufacturing capability and has enabled it to win new business, particularly in the medical market.

Dr Basu adds: “Those deals gave us scale. It also changed people’s perception of us, they had to sit up and take notice.

“The aim of the business is to grow on both sides of the Atlantic, but County Durham is where our home is and where we started off.

“But more importantly this is closer to larger markers in Europe and the Middle East, but the US is such a big market in itself we need a foothold over there.

“Everything we do is compact, high resolution, networkable, so we are following the trend in the market to offer new solutions.

“That is how small companies can thrive. We have very innovative technology and a very fast reaction time to market., if we see an opportunity we can react. We have built up this business like a set of Lego bricks that we can put together in a number of different ways. It’s not about building everything from scratch for each application.

“Overall if I look back over the decade when I was the first guy through the door at Durham Scientific Crystals my vision was always to build a company with global reach and global impact. It has not been a straight path. Sometimes it has been a bit convoluted, but I’m sure most business have that. We are a long way from our end goal. Our ambition is large.

“Profitability has taken longer than we envisaged, but year on year our scope, opportunity and scale has increased. Every year the prospects have got brighter and that is why the investors continued to believe in us and we had a successful IPO.

“We are sitting on the cusp of some exciting opportunities.

“It is jam tomorrow in certain ways, but we are growing in pretty much every part of the business. So it is a growth story. The problem is the rate of growth which is where we failed to meet the expectations and we have to take responsibility for that. We didn’t achieve what we said we would.

We have the best (contract) pipeline in our history. “The scalability of this business is huge. This is the strongest we have ever been. I have never been so excited. Many of the things we have worked so hard for are crystallising now.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here