EasyJet shares were trading at two-year highs as Ryanair’s pilot shortage and the demise of competitor Monarch paved the way for a strong first quarter for the budget airline.

The company reported a 14.4% rise in revenue to £1.14 billion over the three months to December 31, driven by a 8% jump in passenger numbers to 18.8 million.

The airline also reported a 3.3% drop in the cost per seat, while total revenue per seat grew 6.6%, both at constant currencies.

It was the first trading update under new boss Johan Lundgren, though performance was largely chalked up to weaker competition.

David Madden, a market analyst at CMC Markets, said: “The airline’s reliable reputation stood to them as the collapse of Monarch Airlines and Air Berlin boosted their bookings, and the chaos caused by Ryanair’s flight cancellations also helped easyJet.”

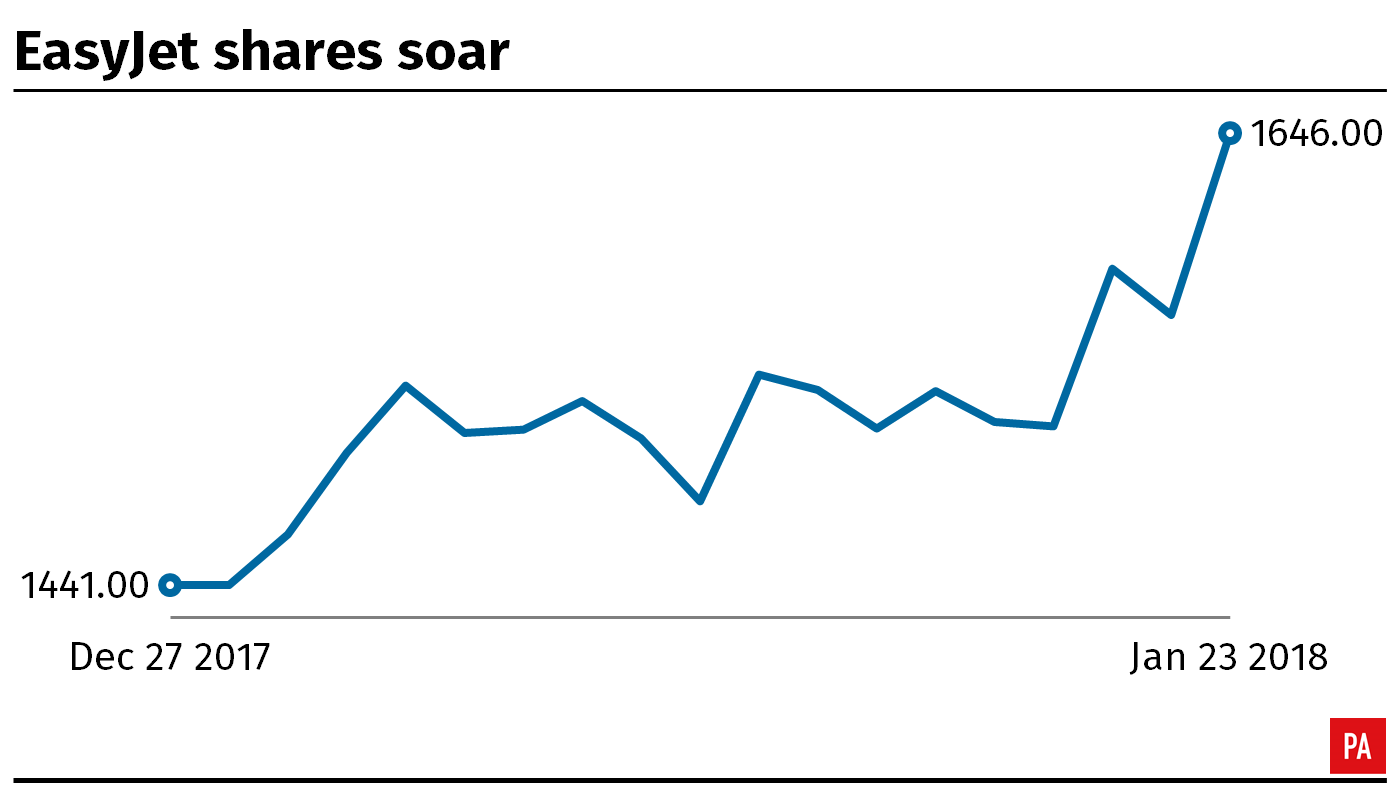

Shares in easyJet jumped more than 5% to around 1,646p, hitting highs not seen since January 2016 and making it one of the best performers on the FTSE 100.

The airline said it will “continue to focus on cost” after generating approximately £28 million in “lean savings” in the quarter, and would shortly roll out its full summer 2018 schedule for its newly established base at Berlin’s Tegel airport.

It comes after the budget carrier snapped up part of Air Berlin’s operation for 40 million euro (£35.2 million) late last year, which included a raft of landing slots as well as the rights to operate passenger transport at Tegel airport.

EasyJet also expects to increase overall annual passenger numbers from 80 million to around 90 million this year, and increase its fleet by around 20 planes to total 300 aircraft by the spring.

Commenting on the results, Mr Lundgren said: “EasyJet delivered a strong start to the financial year with a significant growth in revenue in part driven by an increase in passengers flown and strong growth in inflight and ancillary sales as we offer more and better quality options for our passengers.”

He added: “Our customer proposition will continue to drive both passenger growth and loyalty.

“We have great revenue growth, strong cost control, a robust operation and a strong balance sheet.”

Nicholas Hyett, an equity analyst at Hargreaves Lansdown said conditions “finally” seem to be easing in the short haul market.

“Demand remains high, but with capacity growth slowing, and in some cases reversing following bankruptcies and Ryanair’s cancellations, pricing isn’t under the pressure it once was.

“Meanwhile non-fuel operating costs are falling, in part because easyJet is keeping empty seats to a minimum.

“The combination of stable prices and lower costs should bode well for profits.”

The airline also announced several changes to its management structure, with chief commercial officer Peter Duffy having agreed with the new boss that it was “time for him to leave easyJet”.

This follows Mr Lundgren’s decision to move responsibility for pricing, revenue management and ancillary revenue from the commercial department to the airline’s strategy and network director, Robert Carey.

A new role of chief data officer has been created, with responsibility for coordinating the airline’s management of data to improve the customer experience, drive revenue, reduce cost and improve operational reliability.

Paul Moore, easyJet’s communications director, has resigned to take the same role at ITV, where he will work with Mr Lundgren’s predecessor, Dame Carolyn McCall.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here