TEN years ago this week, Northern Rock crumbled, sparking the first run on a British bank in more than a century.

Photographs were beamed around the world of worried customers queueing outside North-East branches to try and withdraw their money.

The run started on September 14, 2007 after the Rock revealed it had agreed emergency funding from the Bank of England.

Its share price tumbled by more than 30 per cent in a single day and the run damaged Britain's reputation as a world financial centre and a good place to do business.

The UK stock market had been somewhat sickly, and a period of volatility had seen banks stop lending to each other due to market fears over high-risk US mortgages.

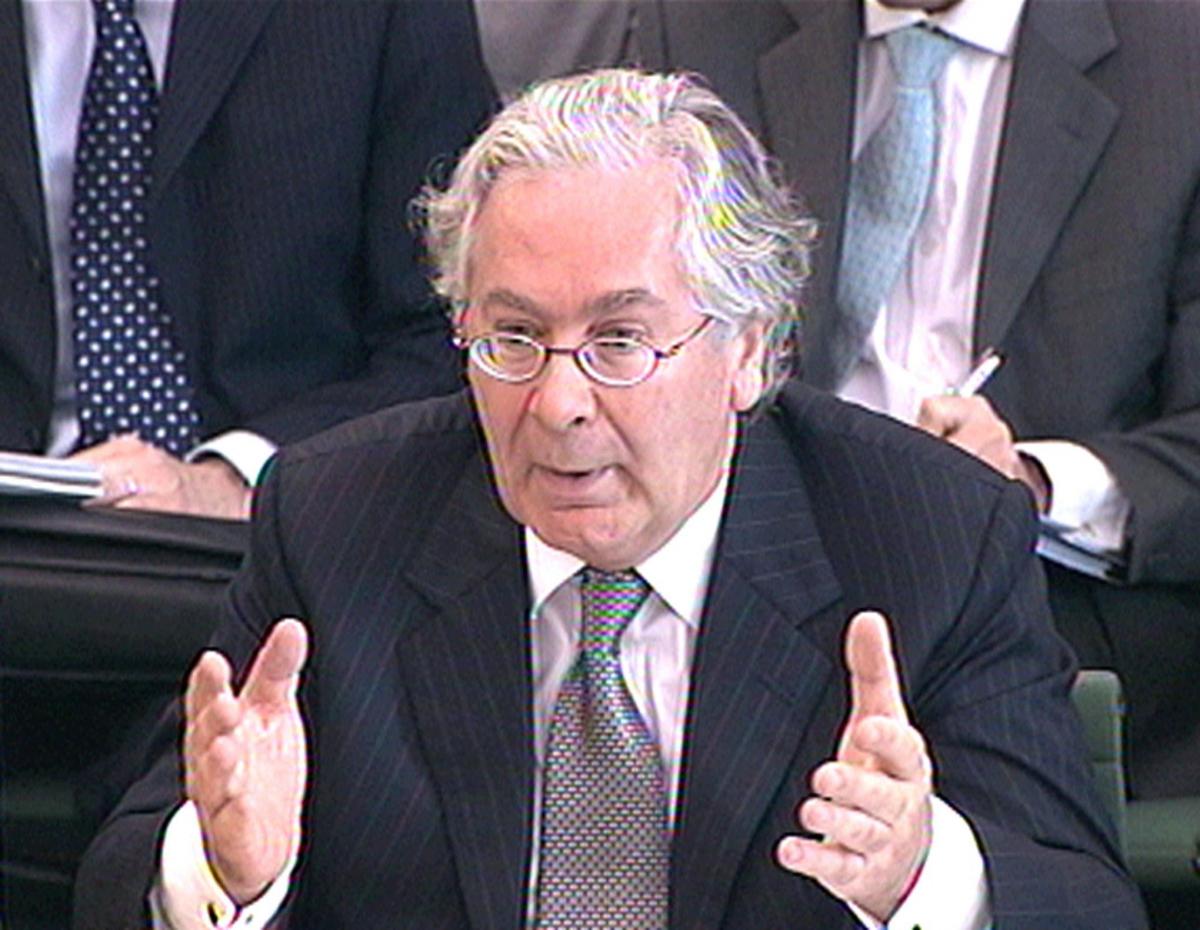

The situation deteriorated on August 16, when the hunt for a potential buyer was launched after former Rock chairman Matt Ridley spoke to Bank of England governor Mervyn King about the possibility of a support operation.

Days later, Financial Services Authority chairman Sir Callum McCarthy wrote to then Chancellor Alistair Darling to indicate the Rock “was running into quite substantial problems”.

When, on Monday, September 10, the bank abandoned attempts to find a buyer, the writing was on the wall.

The Government gave the Rock time to find a white knight to lead its rescue, but ultimately had no choice but to take the beleaguered bank into public ownership.

On New Year’s Day 2010, Northern Rock was officially separated into a savings and mortgage bank called Northern Rock Plc.

This was the “good” bank that would eventually be sold off into the private sector, with Northern Rock Asset Management, which at the time held £54.5bn of more toxic mortgages and unsecured personal loans, remaining in public ownership.

That "good" part was eventually sold to Richard Branson's Virgin Money for £747m, with estimations put forward that the sale saw taxpayers hit with a "paper" loss of between £400m and £650m.

The sale went through on January 1, 2012.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here