In his first interview since taking over as Chairman of Darlington Building Society, Jack Cullen talks to Peter Barron about his career and aspirations for the 161-year-old institution he now leads

AS he looks back on an impressive 44-year career in banking, Jack Cullen can’t help chuckling and wondering aloud: “How did that all happen?”

“I honestly can’t think of a role I actually applied for,” says the genial Scotsman. “Each step always seemed to result from a tap on the shoulder or a quiet word about whether I might be interested in an opportunity.”

It has certainly been a remarkable climb up the financial sector’s career ladder for a man who chose not to go to university and never trained as a banker.

His latest move has seen him take over from James Ramsbotham as Chairman of Darlington Building Society at a time when the independent mutual has reported its most solid set of results for years.

Again, the chairmanship wasn’t part of Mr Cullen’s plan when he joined Darlington Building Society as a non-executive director in January 2015.

“I had no aspirations to become Chairman but James asked me to give it some consideration,” he says. “My whole ethos is about whether I can add value. If I didn’t think I could do a good job, I wouldn’t have put my name forward. But I thought there was an opportunity for me to add something, so my name went into the hat.

“There was a feeling of belonging very quickly when I came to Darlington Building Society and to now be appointed as Chairman is a great honour.”

And yet that pride is accompanied by an enduring sense of surprise at how far he’s come in a profession he entered by chance.

Born in Stenhousemuir, he was one of only two students from his class who didn’t go to university. It was simply a case of not knowing what to study, so he took a job as a trainee computer operator with an insulation company in 1972.

They were the days when primitive computers were huge, and Mr Cullen hadn’t even heard of computer operators, but he decided to give it a whirl. Nine months later, convinced he could do better, he moved to Edinburgh to work as an IT operator for engineering company Ferranti.

Directly opposite Ferranti was Bank of Scotland and in 1974 he moved over the road to take up his first role in the financial sector, working with the bank’s IT team.

It was an inspired move because he ended up staying with Bank of Scotland through various mergers and acquisitions until 2009. From IT, he went into computer auditing and soon found himself being made the bank’s Head of Internal Audit.

“Quite a coup for someone who hadn’t trained as a banker,” he smiles.

In 1995, he was asked to lead a project to establish Sainsbury’s Bank, which he describes as “one of the best experiences of my life”.

After a short period in America, charged with creating a retail bank which never quite came to fruition, he returned to the UK as Deputy Chief Executive of Sainsbury’s Bank in 1999.

He was building a reputation for having an amazing knack for taking disparate information and turning it into something cohesive, and the taps on the shoulder continued to come thick and fast. In 2001, he went back to Bank of Scotland as Chief Risk Officer in the Retail Division, and when the Bank of Scotland merged with Halifax, he became General Manager Banking in the Retail Division for HBOS PLC.

“I always felt the Bank of Scotland was the biggest family-orientated company I could have found,” he says. “But HBOS was a real powerhouse with an immense feeling of everyone pulling in the same direction with the customer at its heart,” he adds.

By 2003, HBOS had made him Chief Risk Officer in the Retail Division, with the untrained banker now responsible for £200bn of assets and entrusted with bringing disparate functions together.

Having succeeded in the challenge, he was appointed Head of Group Business Risk for HBOS in 2005 but the financial crisis was looming. HBOS was taken over by Lloyds, and Mr Cullen became Group Security and Fraud Director for the Lloyds Banking Group in Jan 2009.

In 2010, he joined the Financial Services Authority as a consultant before he was approached to become Managing Director, Enterprise Risk for the National Australia Group (Europe) in 2011.

Three and a half years later, and approaching 60, he thought he’d made his final move but realised he wasn’t ready to retire.

“It’s important to me that I feel I belong somewhere so I decided to look to go down the non-executive route,” he recalls.

He joined the board of Darlington Building Society in January 2015, with responsibilities including acting as Chair of the Board Risk Committee.

“When I look back, I’ve been learning since the first day in my first job,” he says. “I started in the lowest grade of banking and progressed through graft and application. You don’t need a university degree, but if you apply yourself and understand what people are trying to do, it’s amazing what can be achieved. It’s all about taking people with you.”

He knows he’s got big shoes to fill but is excited at the prospect of making his own impact as Chairman.

“James and I are very different. He’s a fantastic ambassador for the North-East and the consummate professional,” he acknowledges. “My challenge is to make my mark on Darlington Building Society and all that means in the region and to do it in a respectful way that maintains the values of the organisation.

“But me taking over as chairman won’t mean a change of strategy. It’s about managing the scale of that business and excelling at what we do best – providing unrivalled service.

“We have a fantastic team and we are in a better position now than for a number of years, so we can look to the future with a great deal of optimism.”

His appointment as Chairman has also coincided with the announcement that Chief Executive Colin Fyfe is moving on at the end of the year to take up a similar role in the Midlands.

“Everyone in the organisation will be sad to see Colin go but we wish him every success,” says Mr Cullen. “He’s done a fantastic job over the past five years but the strategy is DBS’s strategy, not Colin’s strategy, with everyone playing a part. Our aspirations won’t change. My task is to find someone who understands the values of the society and take up the mantle Colin leaves behind.”

It’s a testament to the regard in which Mr Fyfe is held that he will be involved in choosing his successor. In the meantime, the new Chairman insists it will be “business as usual”.

And that’s because business is good, so why change it? The latest set of results include a 1,000-strong rise in members; assets growth up by more than seven per cent; net profits up 6.6 per cent; and gross lending up more than 30 per cent.

He’s particularly proud of a 97.3 per cent customer satisfaction rating and the fact that the building society’s pledge to share five per cent of its profits with local communities has led to £70,000 being handed out to good causes, with more than 8,600 people directly supported.

“The strategy of sharing five per cent of our profits with the community will continue. The more we grow, the more we can give to good causes.

“It’s also important that the members decide who benefits because that ties us all together. And it’s not just about money, it’s also about a commitment to volunteering that puts us at the heart of the community.”

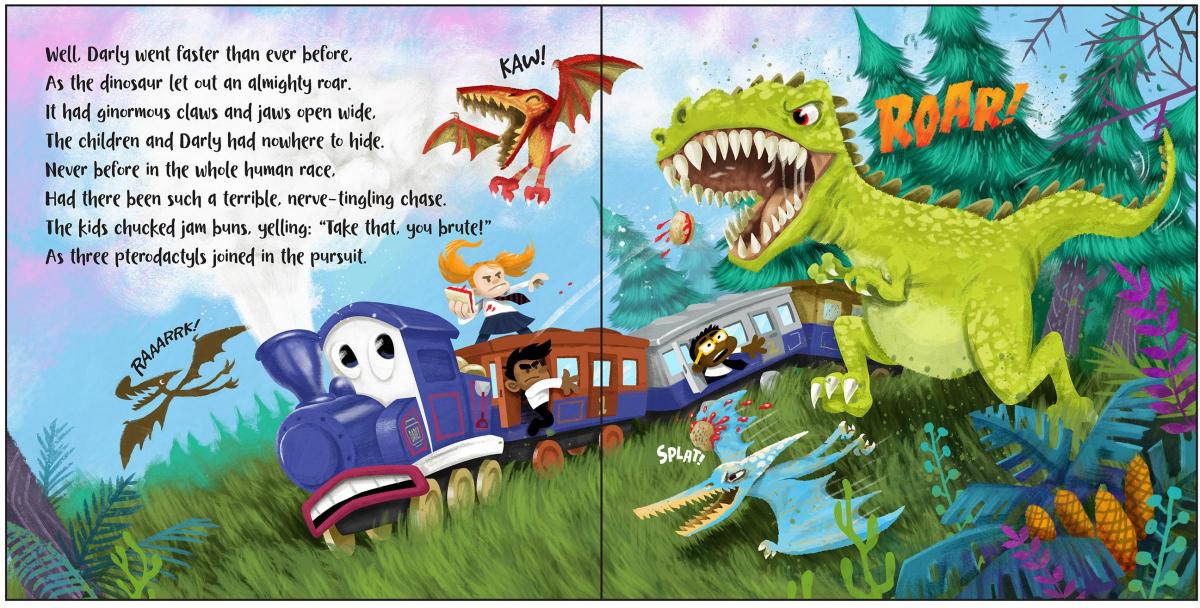

He cites the recent publication of children’s book “Darly’s Magical History Ride” as a particularly creative way of marketing the company and cementing the brand in the community. Darly, the steam train, is the mascot for junior accounts and proceeds from book sales will go to the Darly Children’s Foundation, buying books for school libraries.

So, what does the next chapter have in store for Darlington Building Society as it steams ahead under its new chairman?

“The board spoke last year about our level of ambition. How big do we want to be? How good do we want to be? For me, it’s about how good we can be first. If we’re really good at what we do, with great products, well-priced, and delivered with great service, we’ll grow,” he says.

The society has assets of £585m now and the chairman’s “aspirational but realistic target” is £750m by 2020.

“We’ll aim to get there by always thinking about how our actions benefit members,” he says. “We will see more member engagement because we will be shaped by an understanding of what they want and what they need.”

Darlington Building Society recently celebrated winning the “Best Savings Provider” at the British Bank Awards and it is the fact that DBS was nominated by its members and customers which gives Mr Cullen special satisfaction.

The way people manage their finances is changing, of course, and Mr Cullen acknowledges that there will be a need to embrace the increasing focus on online and digital banking. But he is passionate about there still being a place in the future for community-focussed organisations like Darlington Building Society, which provide personal service in branches.

“Anyone can grow but we want to grow in right way. We will grow sensibly, calmly, and logically to drive value so we can go on supporting our members and our communities.

“The objective is to build on local loyalty by doing things that benefit local people. For example, we want to support first-time buyers in the local market by providing mortgages through branches at a rate lower than any other channel – and, in some cases, these mortgages also carry unique features.

“We can do that because we now have a sustainable business model – and that’s really important after 161 years in business because we want to be here for another 161 years.”

Mr Cullen will be a regular visitor to Darlington but he will continue to live in his native Scotland with wife Linda. She was the secretary all those years ago when he took his first job at the insulation company. They’ve now been married for 44 years and she’s been with him throughout his career: every new role, every quiet word, every step up the ladder.

And Jack Cullen isn’t finished yet. As the new Chairman of Darlington Building Society, he’s relishing the honour and challenge of building on success – local success that makes a meaningful difference.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here