A PAWNBROKER is driving on with expansion plans after revealing a “transformational” year will push profits beyond bosses’ targets.

Ramsdens Holdings aims to open more than ten stores in the coming year after demand for its lending services was accompanied by growth across jewellery sales and a currency exchange operation.

Officials at the business, which has outlets in Darlington, Durham City, Bishop Auckland and Newton Aycliffe, County Durham, say the successes mean they expect adjusted annual pre-tax profits to comfortably outstrip previous expectations.

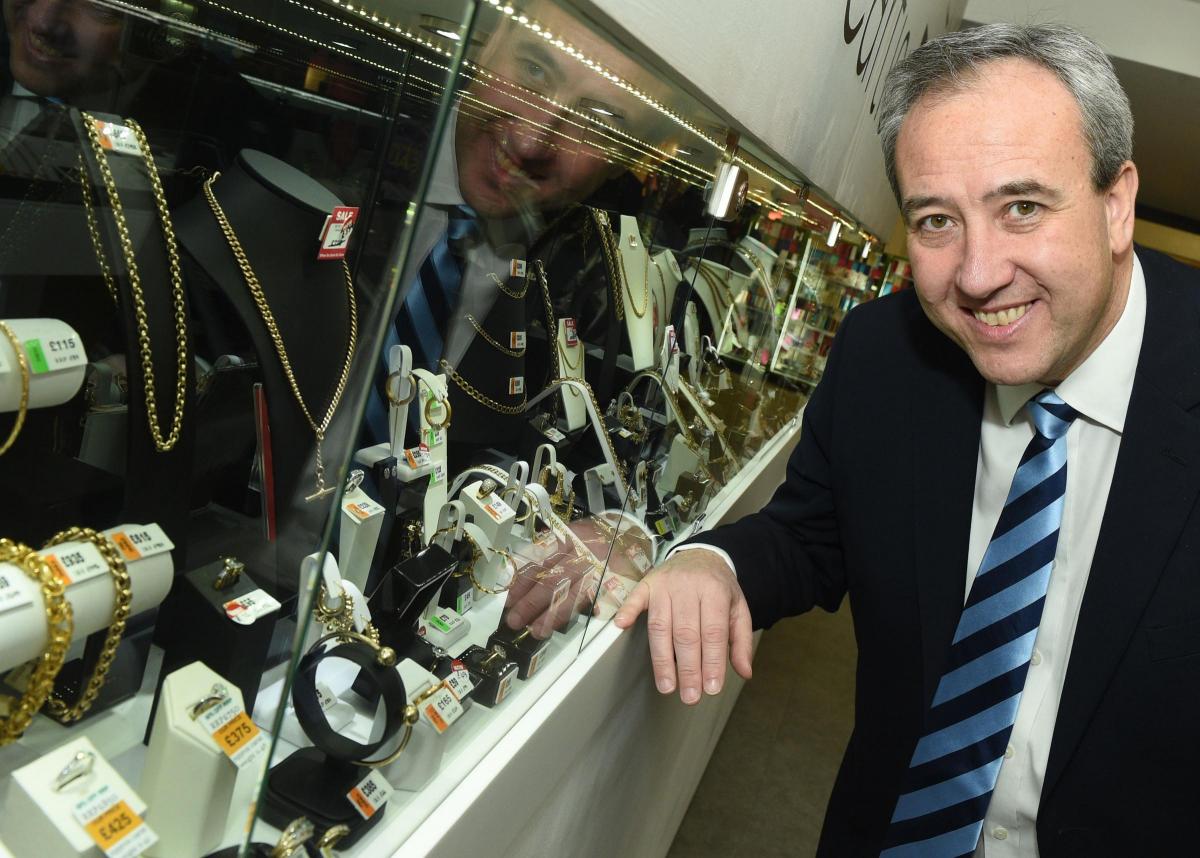

Peter Kenyon, chief executive at the firm, which is more commonly known as Ramsdens and operates nearly 130 stores across the UK, said the positive outlook provides confidence it can fulfil previously announced ambitions to open around 12 shops during the forthcoming year.

The plans comes after Ramsdens, which adorns the shirts of Middlesbrough FC and runs its head office from Coulby Newham, near, Middlesbrough, floated on the AIM financial market to pave the way for its next phase of growth.

Mr Kenyon, who at the time of the flotation said the move would give it a market capitalisation of £26.5m, said the business was in a strong position, reiterating its projected profit increase.

He said: “We are delighted to update our shareholders on a transformational year for Ramsdens, which included our successful initial public offering (IPO) in February.

“The group’s strong operational momentum has continued post IPO, resulting in the board anticipating that it will report adjusted profit before tax comfortably ahead of its previous expectations.

“We have a trusted and recognised brand, a leading store portfolio, an exceptional team and a diversified offering.”

Under the terms of its flotation, NorthEdge Capital, which supported a management buyout of Ramsdens in 2014, has dropped its stake in the business from 73.9 per cent to around 30 per cent.

Other stakeholders following the float include City Financial Investment Company Limited, Artemis Investment Management and AXA Investment Managers GS Limited.

The AIM market is known for helping growing companies raise capital need for their expansion.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here