A PAWNBROKER is pushing ahead with store expansion plans after its four-pronged business approach yielded higher revenues.

Ramsdens says it will open around a dozen outlets in Scotland and North and East Yorkshire after traditional loan services were complemented by strong demand across its foreign exchange division.

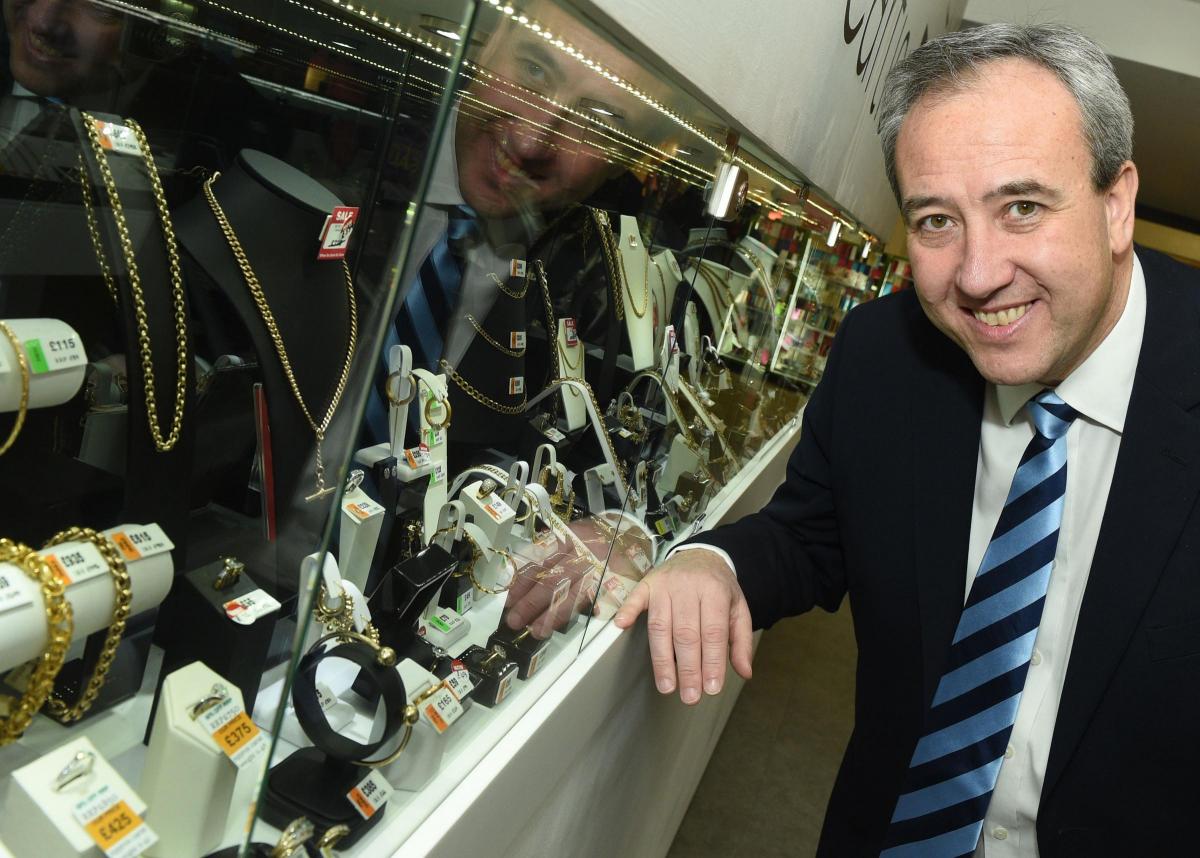

Peter Kenyon, chief executive, told The Northern Echo that the company will “build on what we are already doing”, adding a previous stock market flotation will ensure the business can grow while staying true to its Teesside roots.

He added the store openings are expected to begin in the coming weeks, with Ramsdens keen to build on its existing near-130 UK estate, which includes outlets in Darlington, Bishop Auckland and Newton Aycliffe, County Durham.

Mr Kenyon was speaking today (Wednesday, June 7) after the company, which runs its head office from Coulby Newham, near, Middlesbrough, unveiled annual financial results for the year to March 31.

According to the figures, group revenue was up 15 per cent to £34.5m, with pre-tax profit 73 per cent better off at £4m, after the firm benefited from growth across its core operations.

Foreign exchange sales stood 18 per cent higher at £9m, with precious metals revenue up 17 per cent to £10.8m, pawnbroking revenue seven per cent stronger at £6.1m and jewellery sales up 23 per cent to £5.9m.

Mr Kenyon said the numbers were reflective of a “transformational” year at the business, highlighting foreign exchange as a key driver, with the company estimating it has around a 12 per cent market share in the towns where it operates.

However, he said the firm, which has its name emblazoned on the shirts of Middlesbrough FC, wouldn’t be resting on its laurels.

He told the Echo: “We have had a good year and the team has continued to improve the day-to-day parts of the business.

“We plan to concentrate on what we are already doing and the momentum we have already got in foreign exchange and improvements in retail jewellery.

“We are now focused on getting this even better.”

Although admitting the holiday market has suffered from some customer trepidation after terror attacks at home and abroad, Mr Kenyon said Ramsdens enjoyed a strong year, with officials eyeing a similarly good performance as travellers plan their summer getaways.

He added: “The foreign exchange market is huge and there is a lot of market share we can go after to get the business.

“It is about price and convenience; we have a good offer, we have convenient stores for customers and the Boro shirt really enhances the awareness of the service.

“Last year was a staycation year and it depends this year if there is that terrorism fear factor on travel.

“It is not going away, we have seen that in Manchester and London recently, but we have got good momentum and have optimism the market can continue growing.

“Our offer is better than the Post Office and better than the travel agents and supermarkets.”

Earlier this year, Ramsdens floated on the AIM financial market, which, at the time, Mr Kenyon said would provide a market capitalisation of £26.5m and pave the way for the next phase of the business’ growth.

Under the terms of its flotation, NorthEdge Capital, which supported a management buyout of Ramsdens in 2014, dropped its stake in the business from 73.9 per cent to around 30 per cent.

Other stakeholders following the float include City Financial Investment Company Limited and AXA Investment Managers GS Limited.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here